The Greatest Guide To Fortitude Financial Group

Table of ContentsThe Definitive Guide for Fortitude Financial GroupThe Fortitude Financial Group IdeasNot known Details About Fortitude Financial Group Our Fortitude Financial Group StatementsAn Unbiased View of Fortitude Financial Group

Note that lots of experts won't handle your properties unless you meet their minimal needs (Financial Resources in St. Petersburg). This number can be as reduced as $25,000, or get to right into the millions for the most special experts. When choosing an economic advisor, find out if the private complies with the fiduciary or suitability standard. As kept in mind earlier, the SEC holds all experts signed up with the firm to a fiduciary criterion.The broad field of robos spans platforms with access to financial experts and investment administration. If you're comfortable with an all-digital system, Wealthfront is another robo-advisor alternative.

Financial consultants may run their very own firm or they could be part of a larger workplace or financial institution. No matter, an advisor can aid you with every little thing from developing a monetary plan to spending your money.

Not known Facts About Fortitude Financial Group

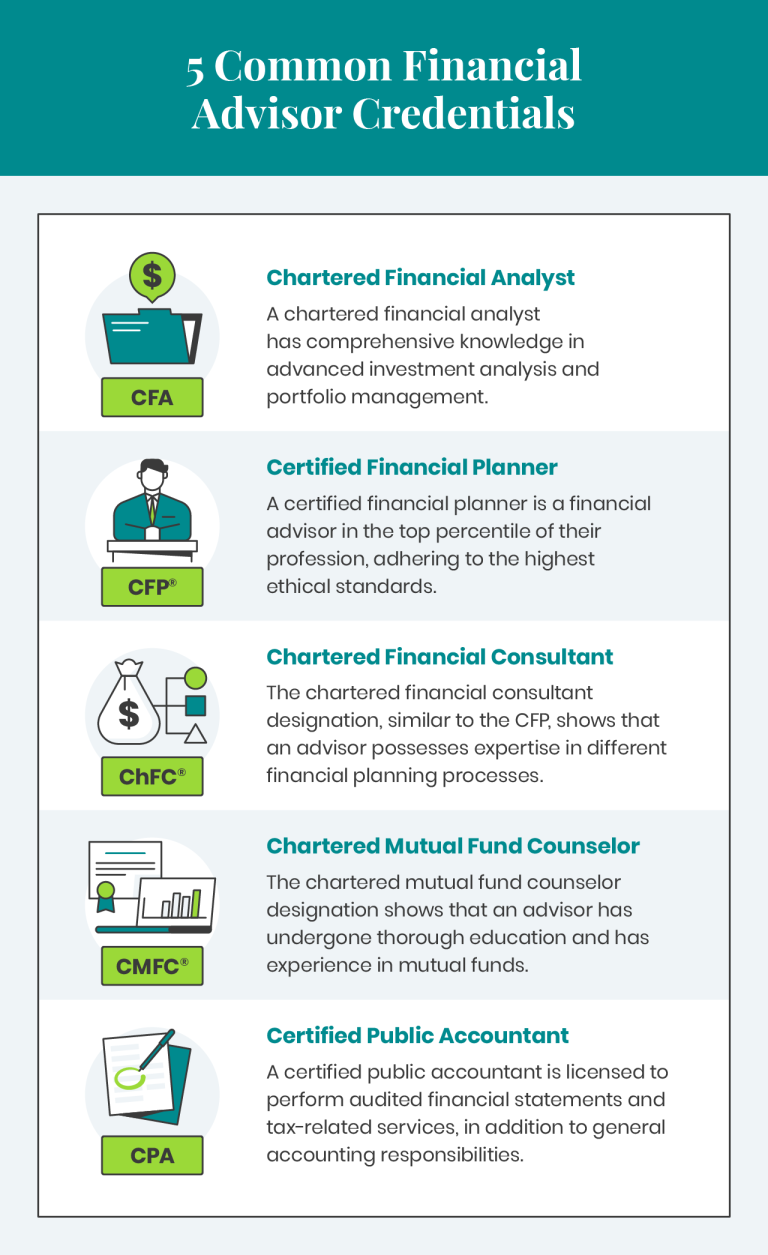

Make sure you ask the best inquiries of anybody you take into consideration employing as an economic consultant. Examine that their qualifications and skills match the solutions you want out of your expert - https://blogfreely.net/fortitudefg1/html-lang-en. Do you wish to discover more about economic experts? Examine out these articles: SmartAsset complies with a rigorous and detailed Editorial Plan, that covers concepts surrounding accuracy, dependability, content self-reliance, proficiency and objectivity.

Most individuals have some psychological link to their cash or the points they buy with it. This emotional connection can be a primary reason we might make poor monetary decisions. An expert financial advisor takes the feeling out of the equation by providing unbiased suggestions based upon knowledge and training.

Rumored Buzz on Fortitude Financial Group

The basics of financial investment management consist of buying and marketing economic possessions and various other investments, however it is moreover. Managing your financial investments includes understanding your short- and long-term goals and utilizing that details to make thoughtful investing decisions. An economic advisor can offer the data required to aid you diversify your financial investment profile to match your desired degree of risk and fulfill your financial objectives.

Budgeting gives you an overview to just how much cash you can spend and just how much you ought to conserve every month. Adhering to a spending plan will certainly aid you reach your short- and long-term financial goals. A financial advisor can assist you lay out the action steps to require to set up and maintain a spending plan that functions for you.

Sometimes a medical expense or home repair can all of a sudden include to your financial obligation tons. An expert financial obligation management plan helps you settle that financial obligation in one of the most economically useful way possible. A monetary advisor can help you evaluate your debt, prioritize a debt settlement technique, supply options for financial obligation restructuring, and outline an alternative strategy to far better take care of debt and fulfill your future financial objectives.

10 Easy Facts About Fortitude Financial Group Shown

Individual capital analysis can inform you when you can afford to buy a new auto or just how much cash you can contribute to your financial savings every month without running short for needed expenses (Financial Services in St. Petersburg, FL). An economic consultant can aid you plainly see where you spend your money and after that apply that understanding to assist you understand your economic well-being and exactly how to improve it

Threat monitoring solutions identify possible risks to your home, your automobile, and your household, and they aid you place the appropriate insurance plan in area to minimize those threats. A monetary expert can assist you create a strategy to safeguard your earning power and lower losses when unexpected points occur.

Fortitude Financial Group for Dummies

Minimizing your tax obligations leaves more money to contribute to your investments. Investment Planners in St. Petersburg, Florida. visit this site right here An economic consultant can assist you make use of charitable providing and investment approaches to reduce the amount you must pay in tax obligations, and they can show you just how to withdraw your money in retirement in a manner that likewise reduces your tax burden

Also if you didn't begin early, university planning can aid you put your child via university without facing suddenly huge expenses. An economic expert can direct you in recognizing the very best ways to save for future university costs and just how to fund potential spaces, discuss exactly how to decrease out-of-pocket university prices, and encourage you on qualification for financial aid and grants.

Comments on “Fortitude Financial Group - Questions”